亲爱的FRM学员:欢迎来到融跃教育FRM网!

距离2026年5月9日FRM一级考期还有 天!

全国热线:400-963-0708

全国热线:400-963-0708  网站地图

网站地图

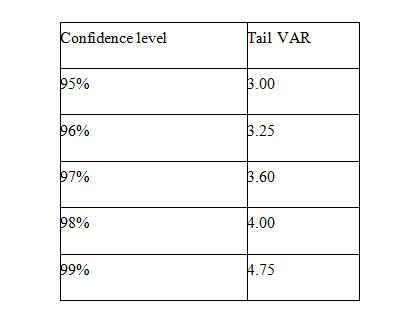

Mill Street Bank has accumulated a long history of loan returns. Mill Street believes that the underlying distribution of loan returns should follow a normal distribution with a mean of ten and a standard deviation of three. The following table identifies tail VARs at different confidence levels. Assume the initial analysis uses five tail slices. Calculate the expected shortfall at the 95% confidence level and identify the effect on ES when the number of tail slices increases.

AExpected Shortfall:3.72 (Increasing Slices)ES increases

BExpected Shortfall:3.72 (Increasing Slices)ES decreases

CExpected Shortfall:3.90 (Increasing Slices)ES increases

DExpected Shortfall:3.90 (Increasing Slices)ES decreases

打开微信扫一扫

添加FRM讲师

课程咨询热线

400-963-0708

微信扫一扫

还没有找到合适的FRM课程?赶快联系学管老师,让老师马上联系您! 试听FRM培训课程 ,高通过省时省心!