亲爱的FRM学员:欢迎来到融跃教育FRM网!

距离2026年5月9日FRM一级考期还有 天!

全国热线:400-963-0708

全国热线:400-963-0708  网站地图

网站地图

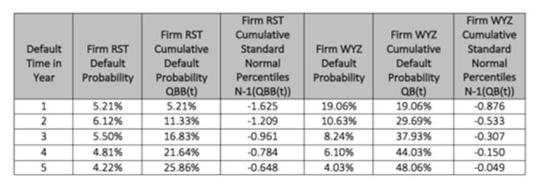

A hedge fund that runs a distressed securities strategy is evaluating the solvency conditions of two potential investment targets. Currently firm RST is rated BB and firm WYZ is rated B. The hedge fund is interested in determining the joint default probability of the two firms over the next two years using the Gaussian default time copula under the assumption that a one-year Gaussian default correlation is 0.36. The fund reports that XBB and XB are abscise values of the bivariate normal distribution presented in the table below where XBB = N-1(QBB(tBB)) and XB= N-1(QB(tB)) with tBBand tB being the time-to-default of BB-rated and B-rated companies respectively; and QBB and QB being the cumulative distribution functions of tBB and tB , respectively; and N denote the standard normal distribution:

Applying the Gaussian copula, which of the following corresponds to the joint probability that firm RST and firm WYZ will both default before the end of year 2?

AQ(XBB = 0.0612) + Q(XB = 0.1063) – Q(XBB = 0.0612)*Q(XB = 0.1063)

BQ(XBB = 0.1133) + Q(XB = 0.2969) – Q(XBB = 0.1133)*Q(XB = 0.2969)

CQ(XBB ≤ 0.1133 ∩XB ≤ 0.2969)

DQ(XBB ≤ – 1.209 ∩ XB ≤ –0.533)

打开微信扫一扫

添加FRM讲师

课程咨询热线

400-963-0708

微信扫一扫

还没有找到合适的FRM课程?赶快联系学管老师,让老师马上联系您! 试听FRM培训课程 ,高通过省时省心!