亲爱的FRM学员:欢迎来到融跃教育FRM网!

距离2026年5月9日FRM一级考期还有 天!

全国热线:400-963-0708

全国热线:400-963-0708  网站地图

网站地图

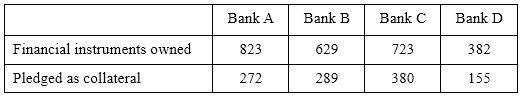

In recent years, large dealer banks financed significant fractions of their assets using short-term, often overnight repurchase (repo) agreements in which creditors held bank securities as collateral against default losses. The table below shows the quarter-end financing of four broker-dealer banks. All values are in USD billions:

In the event that repo creditors become nervous about a bank’s solvency, which bank is least vulnerable to a liquidity crisis?

ABank A

BBank B

CBank C

DBank D

打开微信扫一扫

添加FRM讲师

课程咨询热线

400-963-0708

微信扫一扫

还没有找到合适的FRM课程?赶快联系学管老师,让老师马上联系您! 试听FRM培训课程 ,高通过省时省心!