亲爱的FRM学员:欢迎来到融跃教育FRM网!

距离2026年5月9日FRM一级考期还有 天!

全国热线:400-963-0708

全国热线:400-963-0708  网站地图

网站地图

发布时间:2022-02-28 09:16编辑:融跃教育FRM

在FRM考试中,考生备考一定要找到适合自己的学习方法。看网课也是很重要的。FRM考试中FRM真题很重要吗?

关于FRM真题也是很重要的,下面是小编列举的相关真题,希望对备考的你有所帮助!

Jason Connor, FRM, is a hedge fund manager who is explaining implied volatility for currency options to junior analysts. Which of the following statements best completes his explanation?

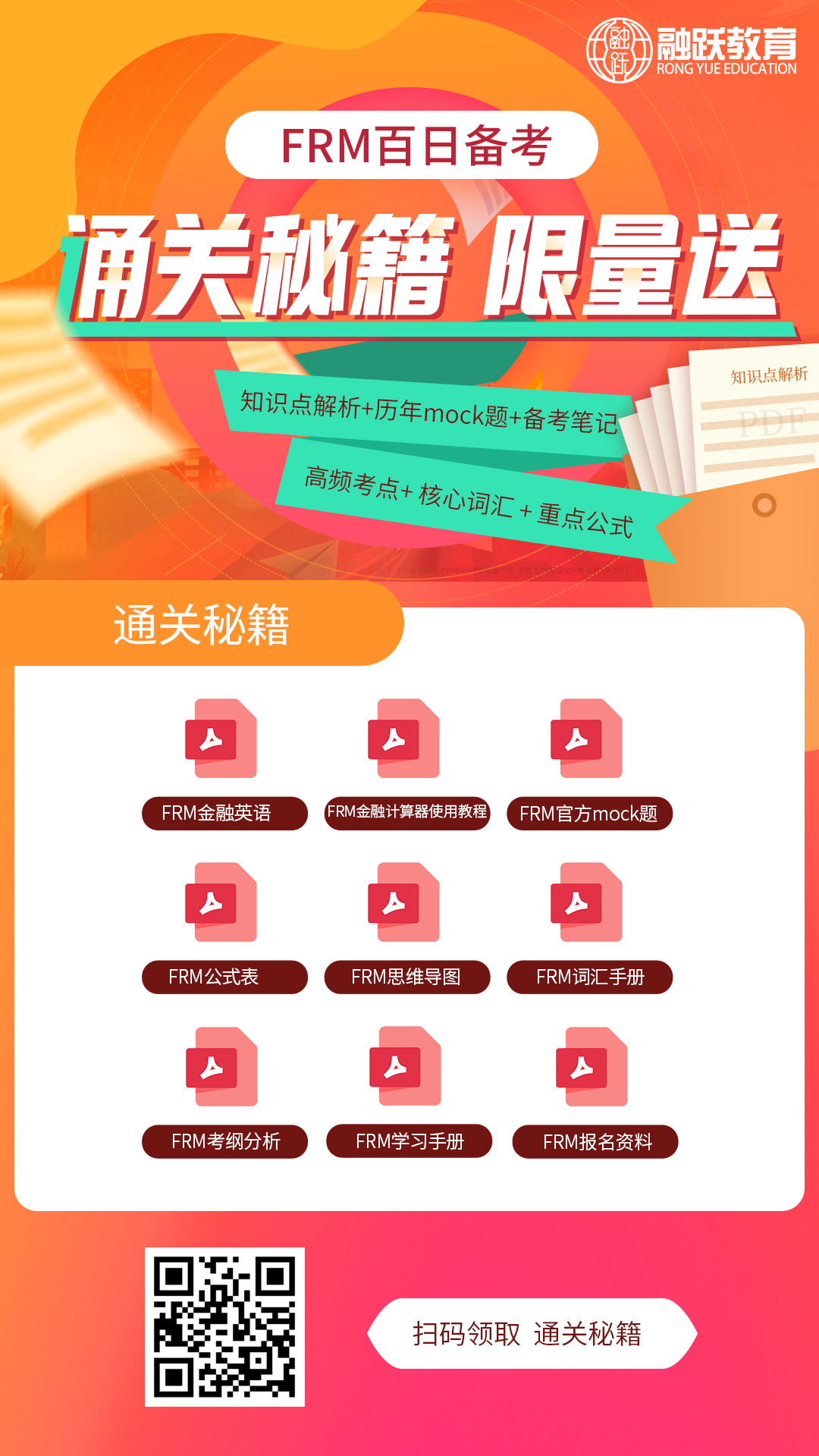

》》》2022年新版FRM一二级内部资料免费领取!【精华版】

A) There is a greater chance of extreme price movements than predicted by a lognormal distribution.

B) Arbitrage opportunities clearly exist.

C) The implied volatility of currency options is expected to increase in the near future.

D) There are no arbitrage opportunities unless the implied volatility versus strike price represents a skewness that is referred to as a smirk rather than a smile.

答案:A

解析:If the implied volatilities for actual currency options are greater for away-from-the-money options than at-the-money options, then currency traders must think there is a greater chance of extreme price movements than predicted by a lognormal distribution. Empirical evidence supports this hypothesis.

Which of the following regarding equity option volatility is true?

A) There is higher implied price volatility for away-from-the-money equity options.

B) “Crashophobia” suggests actual equity volatility increases when stock prices decline.

C) Compared to the lognormal distribution, traders believe the probability of large down movements in price is similar to large up movements.

D) Increasing leverage at lower equity prices suggests increasing

volatility.

答案:D

解析:There is higher implied price volatility for low strike price equity options. “Crashophobia” is based on the idea that large price declines are more likely than assumed in Black-Scholes-Merton prices, not that volatility increases when prices decline. Compared to the lognormal distribution, traders believe the probability of large down movements in price is higher than large up movements. Increasing leverage at lower equity prices suggests increasing volatility.

如果想要获得更多关于FRM考试的真题解析,点击在线咨询或者添加融跃老师微信(rongyuejiaoyu)!

上一篇:compulsory liquidation:FRM考试金融词汇介绍!

下一篇:European Options:FRM考试金融词汇介绍!

热门文章推荐

打开微信扫一扫

添加FRM讲师

课程咨询热线

400-963-0708

微信扫一扫

还没有找到合适的FRM课程?赶快联系学管老师,让老师马上联系您! 试听FRM培训课程 ,高通过省时省心!