亲爱的FRM学员:欢迎来到融跃教育FRM网!

距离2026年5月9日FRM一级考期还有 天!

全国热线:400-963-0708

全国热线:400-963-0708  网站地图

网站地图

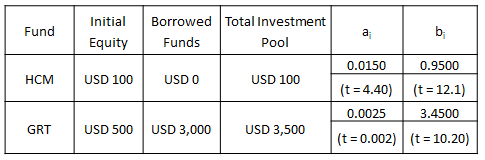

Rick Masler is considering the performance of the managers of two funds, the HCM Fund and the GRT Fund. He uses a linear regression of each manager’s excess returns (ri) against the excess returns of a peer group (rB): ri = ai + bi * rB+ei The information he compiles is as follows:

Based on this information, which of the following statements is correct?

AThe regression suggests that both managers have greater skill than the peer group

BThe ai term measures the extent to which the manager employs greater or lesser amounts of leverage than do his/her peers

CIf the GRT Fund were to lose 10% in the next period, the return on equity (ROE) would be -60%

DThe sensitivity of the GRT fund to the benchmark return is much higher than that of the HCM fund

打开微信扫一扫

添加FRM讲师

课程咨询热线

400-963-0708

微信扫一扫

还没有找到合适的FRM课程?赶快联系学管老师,让老师马上联系您! 试听FRM培训课程 ,高通过省时省心!