亲爱的FRM学员:欢迎来到融跃教育FRM网!

距离2026年5月9日FRM一级考期还有 天!

全国热线:400-963-0708

全国热线:400-963-0708  网站地图

网站地图

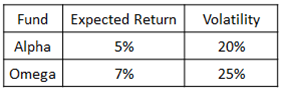

Consider a USD 1 million portfolio with an equal investment in two funds, Alpha and Omega, with the following annual return distributions:

Assuming the returns follow the normal distribution and that there are 252 trading days per year, what is the maximum possible daily 95% Value-at-Risk (VaR) estimate for the portfolio?

AUSD 16,587

BUSD 23,316

CUSD 23,459

DUSD 32,973

打开微信扫一扫

添加FRM讲师

课程咨询热线

400-963-0708

微信扫一扫

还没有找到合适的FRM课程?赶快联系学管老师,让老师马上联系您! 试听FRM培训课程 ,高通过省时省心!