亲爱的FRM学员:欢迎来到融跃教育FRM网!

距离2026年5月9日FRM一级考期还有 天!

全国热线:400-963-0708

全国热线:400-963-0708  网站地图

网站地图

发布时间:2022-02-15 09:58编辑:融跃教育FRM

在备考中对于FRM考生重要的事情是什么,那当然是对于FRM真题的练习了。考生一定要做大量的真题,这样对于考试才是有帮助的!下面是相关例题的解析,一起了解一下!

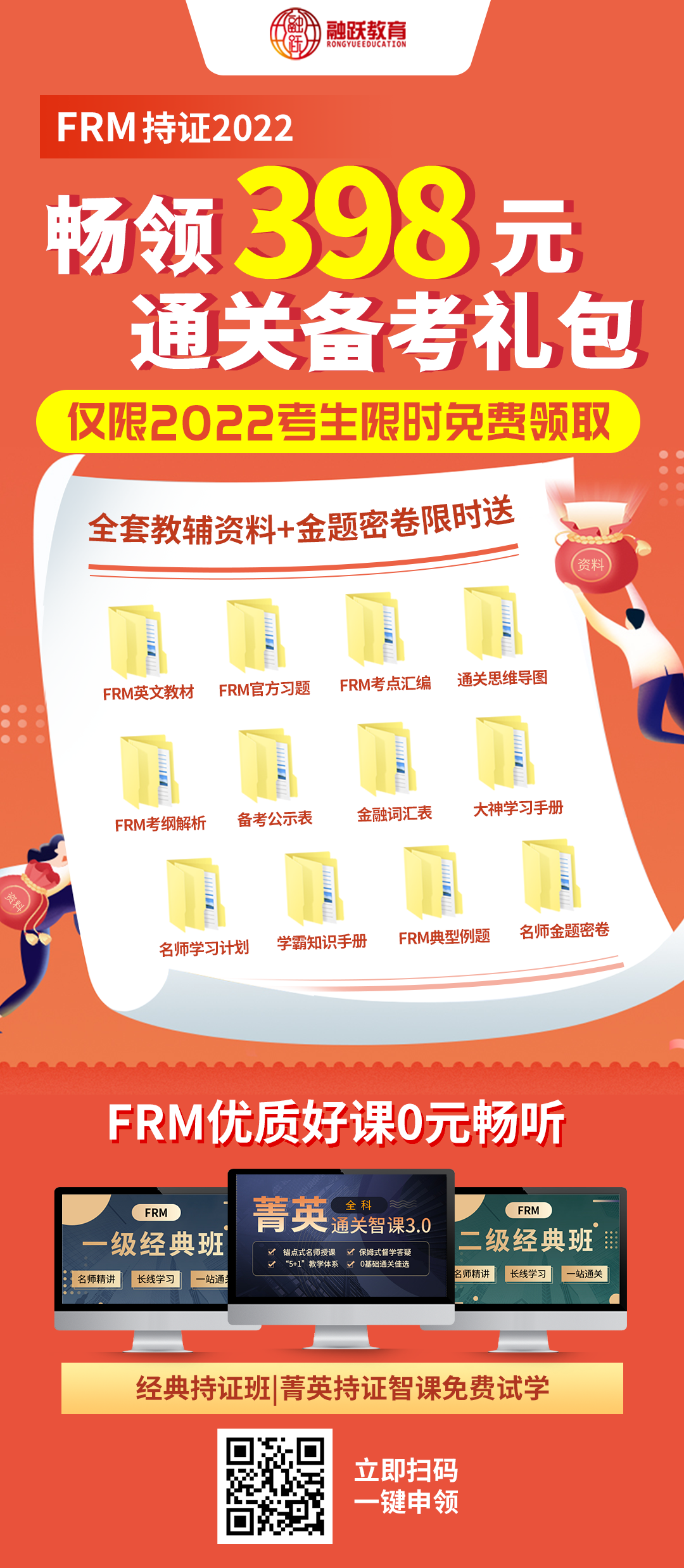

》》》2022年新版FRM一二级内部资料免费领取!【精华版】

An analyst is using the delta-normal method to determine the VAR of a fixed income portfolio. The portfolio contains a long position in 1-year bonds with a $1 million face value and a 6% coupon that is paid semiannually. The interest rates on 6- and 12-month maturity zero-coupon bonds are 2% and 2.5%, respectively. Mapping the long position to standard positions in the 6- and 12-month zeros, respectively, provides which of the following mapped positions?

A) $29,703 and $1,004,878.

B) $30,000 and $1,030,000.

C) $29,500 and $975,610.

D) $30,300 and $1,035,000.

答案:A

解析:The long position is mapped into a combination of market values of the

zero-coupon bonds that provide the same cash flows:

X6=30,000/[1+(0.02/2)]=29,703

X12=1,030,000/[1+(0.025)]=1,004,878

There is a short position in 1-year bonds with a $150 million face value and a 6% annual interest rate, with interest paid semiannually. The annualized interest rate on zero-coupon bonds is 3.8% for a 6-month maturity and 4.1% for a 12-month maturity. Decompose the bond into the cash flows of the two standard instruments, and then determine the present value of the cash flows of the standard instruments. What are the present values of each cash flow?

A) PV of CF1:-$4,117,945 PV of CF2:-$139,882,651

B) PV of CF1:-$4,226,094 PV of CF2:-$143,793,919

C) PV of CF1:-$4,416,094 PV of CF2:-$148,414,986

D) PV of CF1:-$4,879,542 PV of CF2:-$144,244,783

答案:C

解析:The standard instruments are -150,000,000×(0.06/2) = -$4,500,000 for six months, and -$4,500,000 – $150,000,000 = -$154,500,000 for 12 months. The present values are -$4,500,000/1.019 = -$4,416,094 and -$154,500,000/1.041 =-$148,414,986

如果想要获得更多关于FRM考试的真题解析,点击在线咨询或者添加融跃老师微信(rongyuejiaoyu)!

上一篇:FRM知识点解析:effective duration!

热门文章推荐

打开微信扫一扫

添加FRM讲师

课程咨询热线

400-963-0708

微信扫一扫

还没有找到合适的FRM课程?赶快联系学管老师,让老师马上联系您! 试听FRM培训课程 ,高通过省时省心!