亲爱的FRM学员:欢迎来到融跃教育FRM网!

距离2026年5月9日FRM一级考期还有 天!

全国热线:400-963-0708

全国热线:400-963-0708  网站地图

网站地图

发布时间:2025-07-02 16:10编辑:融跃教育FRM

FRM一级估值与风险模型例题解析

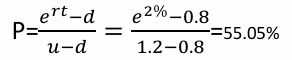

An analyst is pricing a 2-year European put option on a non-dividend-paying stock busing a binomial tree with two time steps of one year each. The stock price can go up or down by 20% each period, and assuming that the annual risk-free rate will remain constant at 2% over the next two years and the annual stock volatility is 15%. Please calculate the risk-neutral probability of an upward movement.

A. 50%

B. 44.95%

C. 55.05%

D. None of above

答案:C

解析:

关联考点:风险中性上涨概率计算

易错点分析:计算上涨因子u和下跌因子d有两种方法,第一个方法是:u=上涨幅度,d=下跌幅度;第二个方法:u=e^西格玛*根号delta;d=e^-西格玛*根号delta,在题干同时给出上涨幅度和波动率时,理论上两种方法的计算结果是一样的,如果有差异,优先使用第一种方法。

Assume we calculate a one-week VaR for a natural gas position by rescaling the daily VaR using the square root rule. Let us now assume that we determine the “true” gas price process to be mean reverting and recalculate the VaR. Which of the following statements is true?

A. The recalculated VaR will be less than the original VaR

B. The recalculated VaR will be equal to the original VaR

C. The recalculated VaR will be greater than the original VaR

D. There is no necessary relation between the recalculated VaR and the original VaR

答案:A--------

解析:The square root rule applies only when the returns are uncorrelated. With mean reversion, natural gas prices are negatively correlated. In that case the VaR computed from the square root rule will overstate the true VaR, and the recalculated VaR that corrects for mean reversion will be less than the original VaR. If the process is mean reverting then we can no longer scale volatility (and associated

VaR) up by the square root of time.

关联考点:VaR计算平方根法则易错点分析:不满足每天的收益独立同分布假设的时间平方根普通法是乘以√T(1+ρ),当ρ大于0时,说明是带有趋势的,平方根法低估VAR;当ρ小于0时,说明是均值复归的,平方根法则高估VAR。通俗来讲,当存在均值复归时,假如昨天的收益率上升,则今天的收益率下降,如此往复,在均值附近波动,如果不存在均值复归,则收益率曲线要么一直上升要么一直下降,波动率比存在均值复归时更大,其VaR值也更大,反之,存在均值复归时的VAR值被低估。

上一篇:FRM一级金融市场产品例题解析weighted average maturity

下一篇:已经是最后一篇文章了

热门文章推荐

打开微信扫一扫

添加FRM讲师

课程咨询热线

400-963-0708

微信扫一扫

还没有找到合适的FRM课程?赶快联系学管老师,让老师马上联系您! 试听FRM培训课程 ,高通过省时省心!