亲爱的FRM学员:欢迎来到融跃教育FRM网!

距离2026年5月9日FRM一级考期还有 天!

全国热线:400-963-0708

全国热线:400-963-0708  网站地图

网站地图

发布时间:2025-07-03 14:36编辑:融跃教育FRM

FRM二级市场风险测量与管理真题解析VaR

【题目1】

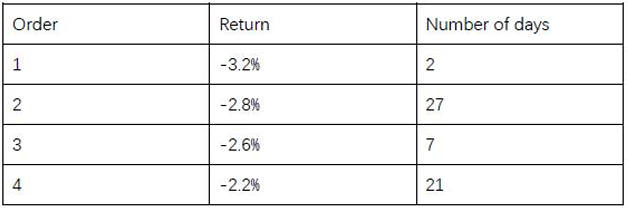

A trader was estimating the 1-day 90% VaR on a domestic commodity portfolio using the historical simulation approach (equally weighted) with a 30-day look back period. The 4 most extreme negative returns over the look back period were:

5 days later, the portfolio has experienced 2 extreme negative returns: -3.0%, -1.9%. What is the new updated VaR now?

A. 3.0%

B. 2.6%

C. 2.8%

D. 3.2%

答案:B

解析: 根据给出的新信息,我们可以得到收益新的升序排序:-3.2%、-3.0%、2.6%,对于30个观察样本来说, 1天的90% VaR是倒数第三收益(10%×30=3)的负数, 即2.6%。

关联考点:VaR计算

易错点分析:

容易选择C选项,因为-2.8%对应27天前,5天过去后,这个数据已经从窗口期中滚动出去了,所以不用再考虑。

【题目 2】

Which of the following statements comparing VaR with expected shortfall is true?

A. Expected shortfall is sub-additive while VaR is not.

B. Both VaR and expected shortfall measure the amount of capital an investor can expect to lose over a given time period and are, therefore, interchangeable as risk measures.

C. Both VaR and expected shortfall depend on the assumption of a normal distribution of returns.

D. VaR can vary according to the confidence level selected, but expected shortfall will not.

答案:A

关联考点:VaR与ES性质对比

易错点分析:容易错选C,VaR与ES对分布并没有严格的假设。

下一篇:FRM二级信用风险真题解析default,lending and counterparty risk

热门文章推荐

打开微信扫一扫

添加FRM讲师

课程咨询热线

400-963-0708

微信扫一扫

还没有找到合适的FRM课程?赶快联系学管老师,让老师马上联系您! 试听FRM培训课程 ,高通过省时省心!