亲爱的FRM学员:欢迎来到融跃教育FRM网!

距离2026年5月9日FRM一级考期还有 天!

全国热线:400-963-0708

全国热线:400-963-0708  网站地图

网站地图

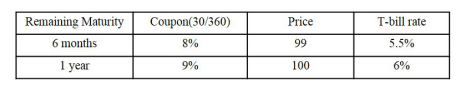

Suppose XYZ Corp. has two bonds paying semiannually according to the following table. The recovery rate for each in the event of default is 50%. For simplicity, assume that each bond will default only at the end of a coupon period. The market-implied risk-neutral probability of default for XYZ Corp. is

AGreater in the first six-month period than in the second

BEqual between the two coupon periods

CGreater in the second six-month period than in the first

DCannot be determined from the information provided

打开微信扫一扫

添加FRM讲师

课程咨询热线

400-963-0708

微信扫一扫

还没有找到合适的FRM课程?赶快联系学管老师,让老师马上联系您! 试听FRM培训课程 ,高通过省时省心!